|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Refinance Companies for Low Credit Scores: Understanding Your OptionsRefinancing can be a challenging process, especially if you have a low credit score. However, there are refinance companies specifically tailored to help those in this situation. Understanding the nuances of these companies and the options available can make the process smoother and more effective. Understanding Low Credit Score RefinancingWhen dealing with low credit scores, it's essential to know that not all refinance companies are created equal. Some specialize in working with individuals who have had financial challenges in the past. What Is a Low Credit Score?A low credit score typically falls below 620. This can be due to various factors, including late payments, high debt levels, or a lack of credit history. However, refinancing is still possible even with these challenges. Types of Refinance Loans AvailableSeveral loan types cater to those with low credit scores, including:

Choosing the Right Refinance CompanySelecting the right company can significantly impact your refinancing experience. Here are some key considerations: Research and CompareIt's crucial to compare different refinance options and companies. Look at interest rates, terms, and customer reviews to gauge reliability and service quality. Check for Hidden FeesSome refinance companies may include hidden fees that can increase your costs. Ensure you understand all associated fees before committing. Common Mistakes to AvoidRefinancing with a low credit score can be tricky, and there are common pitfalls you should avoid:

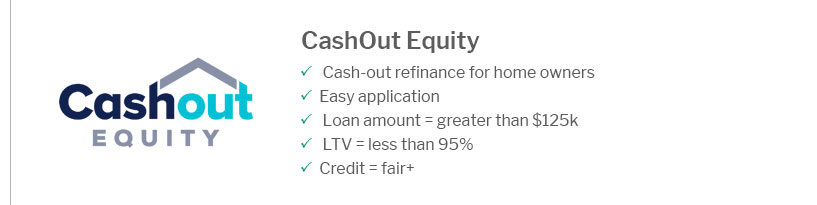

Exploring Further OptionsIf refinancing seems challenging, you might also consider other options like 95 refinance home loans, which offer flexibility for homeowners with varying credit scores. Frequently Asked QuestionsWhat is the minimum credit score needed for refinancing?The minimum credit score varies by lender and loan type, but generally, a score of 580 or higher can qualify you for certain refinance loans, like FHA loans. Can I refinance if I have a history of bankruptcy?Yes, it's possible to refinance after bankruptcy, though there may be a waiting period, and it often requires proving that your financial situation has improved. How can I improve my chances of refinancing with a low credit score?Improving your chances involves paying down debt, making timely payments, and avoiding new credit inquiries before applying for refinancing. https://themortgagereports.com/71499/best-bad-credit-mortgage-lenders

Academy Mortgage is a top-tier lender for home buyers with bad credit, offering a wide array of loan options and exceptional customer service. https://www.lendingtree.com/auto/refinance/best-companies-to-refinance-auto-loan-with-bad-credit/

Where to find companies to refinance a car loan with bad credit ; openroad logo. 460 - 36 to 72 months ; iLending logo. 560 - 12 to 96 months. https://www.nerdwallet.com/best/mortgages/mortgage-lenders-for-low-credit-score-borrowers

14 Best Home Loans for Low or Bad Credit Scores of January 2025 ; AmeriSave: NMLS#1168. Compare More Lenders. on NerdWallet. 4.5. /5. FHA loans.

|

|---|